Comparing US, UK, and Australian Investments: A Guide for Expats and Savvy Investors

Disclosure: This post contains affiliate links, including Amazon Associates links. As an Amazon Associate, I earn from qualifying purchases. If you make a purchase through these links, I may earn a small commission at no additional cost to you

One of my favourite finance advisers is Ramit Sethi, author of the bestselling book I Will Teach You to Be Rich (Amazon). His straightforward, no-nonsense approach to personal finance transformed how I think about money. Since writing that book, he’s shifted his focus to helping couples navigate their finances, and his new book, Money for Couples (Amazon) is a must-read. While I love his take on personal finance and find his advice incredibly useful, there’s one challenge I often face as a British-Australian living in Australia: translating his US-centric investment advice into something that works for Australia.

If you’ve ever read about 401(k)s, Roth IRAs, or ISAs and wondered, “What’s the equivalent in my country?” then you’re not alone. Whether you’re planning for retirement, saving for a home, or building long-term wealth, understanding how US, UK, and Australian investment systems align (or don’t!) is critical—especially if you’re an expat trying to navigate these differences.

In this article, I’ll break down the key US, UK, and Australian investment accounts, highlighting the similarities, differences, and practical tips for making the most of your money in any of these regions.

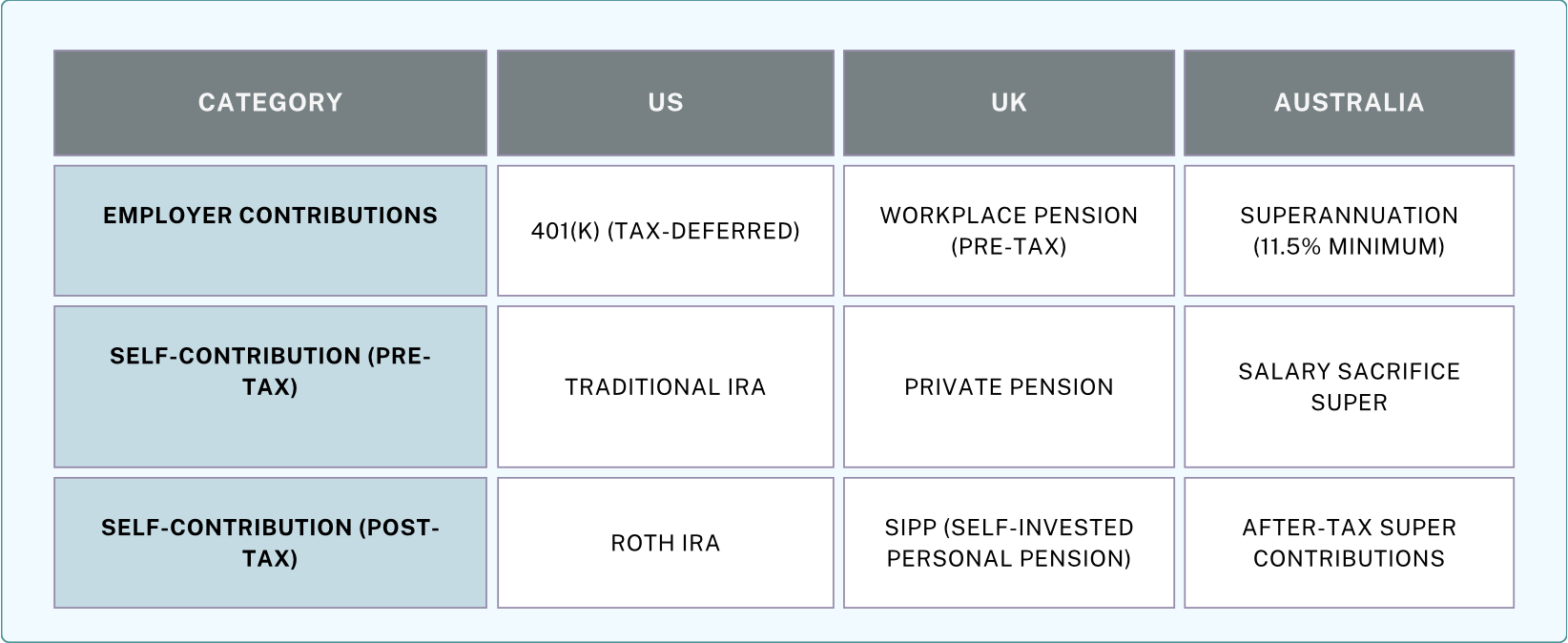

Retirement Accounts

Retirement savings are at the core of any solid financial plan, and each country has its own system for encouraging this.

Retirement Accounts in US, UK and Australia

Key Takeaways:

US: The 401(k) is similar to Australia’s superannuation system, offering tax-deferred savings with employer contributions.

UK: Workplace pensions operate similarly to super but can also be supplemented by private pensions and SIPPs (Self-Invested Personal Pension) for greater flexibility. Self-Invested Personal Pension, is a type of pension that allows you to choose where and how your money is invested.

Australia: Superannuation is a mandatory employer retirement contribution, currently set at 11.5% of an employee's salary, with the contribution rate legislated to increase to 12% by July 1, 2025. Superannuation also allows for additional contributions through pre-tax options (salary sacrifice) and post-tax contributions, offering flexibility for individuals to enhance their retirement savings.

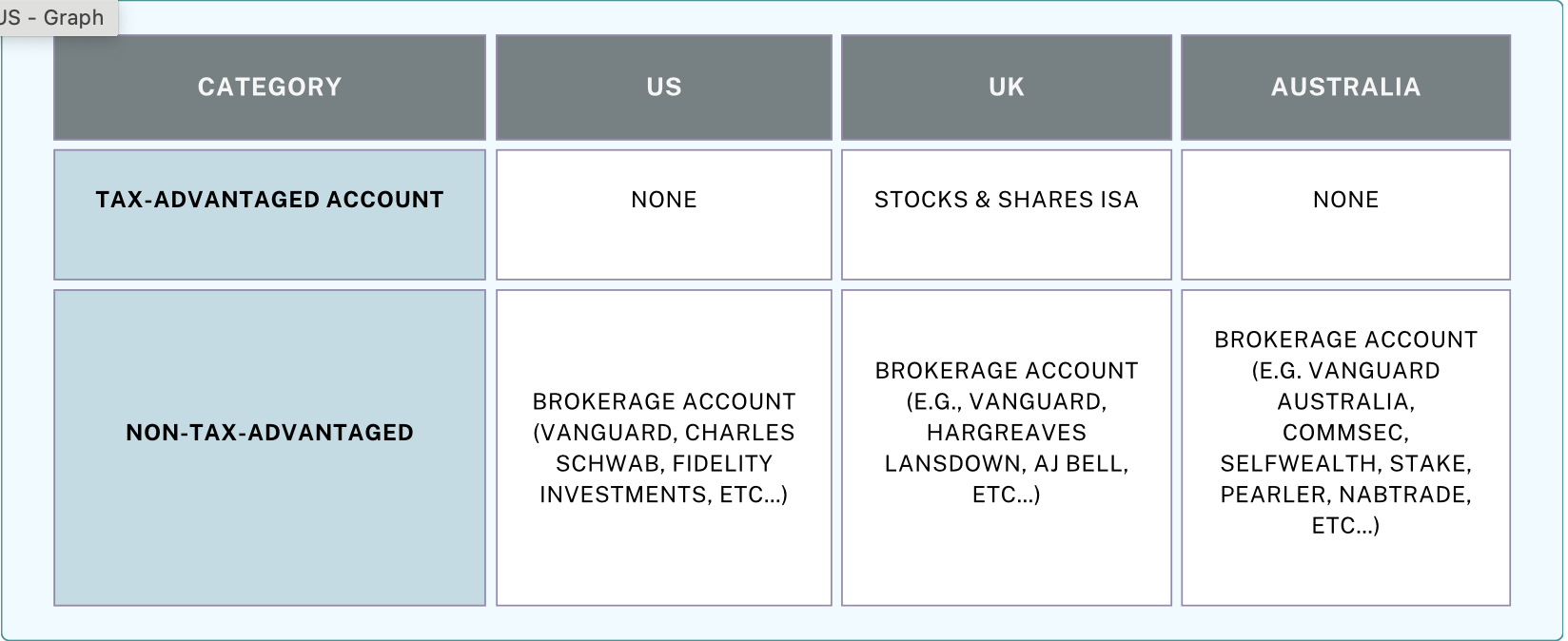

General Investment Accounts

These accounts allow you to invest in stocks, ETFs, mutual funds, and more, but they differ in tax treatment.

General Investment Accounts in US, UK and Australia

Key Takeaways:

US: Brokerage accounts are straightforward but fully taxable.

UK: The Stocks & Shares ISA is a powerful tool, offering tax-free growth and withdrawals within an annual contribution limit.

Australia: Brokerage accounts function similarly to the US but lack a tax-advantaged equivalent to the ISA.

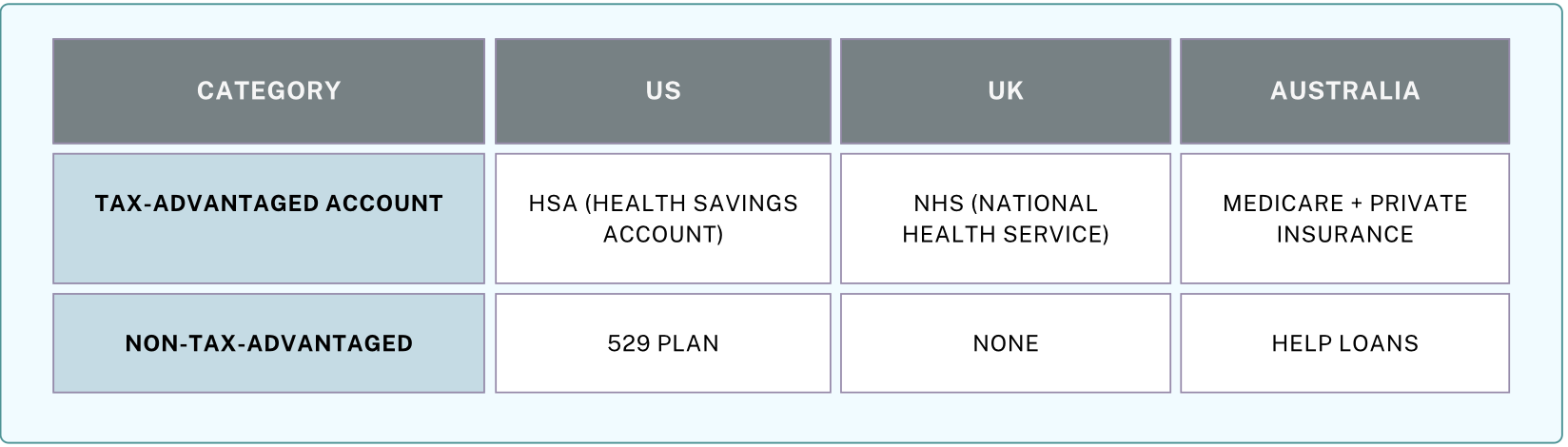

Health and Education Savings

Health and Education Savings in US, UK and Australia

Key Takeaways:

US:

Healthcare: HSAs (Health Savings Accounts) offers a unique triple tax advantages for medical expenses. HSAs reduces your income tax bill when saved, grows tax-deferred while invested, withdraws tax-free when used for qualified medical expenses. These are available to individuals with high-deductible health plans. The Affordable Care Act (Obamacare) expanded healthcare access but is not tied directly to HSAs.

Education: 529 Plans provide tax-free savings for education-related expenses, making them a popular choice for long-term educational planning.

UK:

Healthcare: The NHS (National Health Service) provides free or low-cost healthcare at the point of use, funded by general taxation and National Insurance (NI) contributions. Private health insurance exists but is less common and typically used for faster access to elective treatments.

Education: Education costs are subsidised by the government. However, there are no tax-advantaged savings plans like the US 529 Plan.

Australia:

Healthcare: Medicare ensures universal access to healthcare and is funded through taxation, including the Medicare Levy. Private health insurance is widely used by Australians for services not covered by Medicare or to access faster treatment. While not tax-advantaged, private health insurance helps high-income earners avoid the Medicare Levy Surcharge. It is also a requirement for expats on certain visas.

Education: HELP loans provide affordable funding for higher education. However, Australia lacks a specific education savings account equivalent to the US 529 Plan.

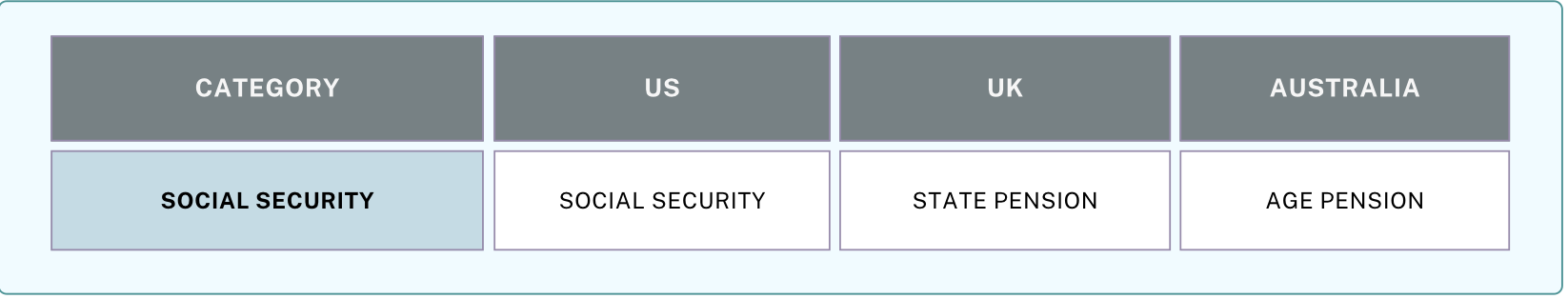

Social Security

Social Security in US, UK and Australia

Key Takeaways:

All three countries provide a government-funded baseline for retirement income, but eligibility, contributions, and amounts differ significantly.

Practical Tips for Managing Investments Across Countries

For Expats Moving Between Systems:

Check if you can consolidate or transfer retirement funds. For example, UK pensions can sometimes be consolidated into a SIPP, but Australian superannuation doesn’t allow inbound transfers from most overseas accounts.

Maximise Tax Advantages:

In the US, consider HSAs and Roth IRAs for tax-free growth.

In the UK, prioritise Stocks & Shares ISAs within the contribution limit.

In Australia, make the most of salary sacrifice contributions to superannuation for tax benefits.

Invest with Your Goals in Mind:

Short- to medium-term goals: Use brokerage accounts for flexibility.

Long-term goals: Prioritise tax-advantaged accounts like superannuation, ISAs, or 401(k)s.

Be Aware of Double Taxation Risks:

For expats, understand how your investments are taxed in both your home and host country. Double taxation agreements (DTAs) can help mitigate this.

Conclusion

Navigating investments across the US, UK, and Australia can feel overwhelming, but understanding the parallels and differences is key to building a strong financial future. By aligning your strategy with the options available in your country, you can optimise your tax advantages, save effectively, and invest confidently.

Please note, I am not a financial advisor. The information provided in this blog reflects my personal understanding of how these systems translate across the three countries and should not be taken as financial or tax advice. I strongly encourage readers to consult with a qualified professional for advice tailored to their individual circumstances.

If you have a different perspective on these matters or additional insights to share, I would love to hear from you in the comments! Additionally, if anyone has a great UK book with financial advice that they could recommend to me, I would be very interested to hear about it.

If you’re interested in learning more, check out Ramit Sethi’s I Will Teach You to Be Rich (Amazon). For couples, his latest book, Money for Couples (Amazon), offers fantastic insights into managing joint finances. Another excellent book for Australians is The Barefoot Investor by Scott Pape (Amazon). It offers fantastic insights into managing personal finances and provides basic tips on superannuation and investments in Australia.

Have you faced challenges navigating investments across these countries? Share your experiences in the comments below!

📩 Join my newsletter for more insights on financial independence & homeownership - Link to Subscribe!