From Construction Sites to Bank Accounts: 10 Quantity Surveying Skills to Transform Your Personal Finances

As a Quantity Surveyor, I’ve developed a range of skills to optimise costs, manage risks, and contribute to delivering successful projects. These skills aren’t limited to construction—they’re powerful tools you can use to master personal or business finances. By applying Quantity Surveying principles to your own finances, you can save money, reduce stress, and build a solid foundation for the future. Whether you’re managing a household budget, saving for a major purchase, or planning for retirement, the techniques we use in construction can transform the way you manage money.

Here are 10 Quantity Surveying-inspired tips to help you master your personal finances.

1. Conduct a “Cost Benchmarking” Exercise for Your Life

In construction, benchmarking involves comparing project costs to industry standards to identify inefficiencies. You can apply this same technique to your finances.

How You Can Use This: Compare your expenses to community or regional averages using tools like Numbeo or cost-of-living reports. These tools can help you pinpoint where your spending is above average. Are you spending more on dining out, utilities, or subscriptions than the typical household? If so, ask yourself if the extra cost is worth it or if there are ways to adjust. Benchmarking is also incredibly useful for those planning a move abroad, as it allows you to compare the cost of living between locations and budget accordingly.

2. Utilise “Value Engineering” for Your Purchases

Value engineering is about maximizing functionality while minimizing costs. It’s a great mindset to bring to personal spending.

How You Can Use This: Before making a purchase, consider whether it offers the best value for money. Focus on quality over quantity—invest in items that are built to last and offer long-term benefits rather than opting for cheaper, short-lived alternatives.

3. Plan Cash Flow Like a Project Schedule

Timing is everything. Just as construction costs are aligned with project milestones, you can plan your expenses in a similar way.

How You Can Use This: For major expenses, such as a vacation or home renovation, align your spending with periods of higher income, like bonuses or tax refunds. Create a timeline to save up in advance by dividing the total cost into manageable monthly amounts. Take advantage of sales periods to make well-timed purchases. Keeping a wishlist can help you track items you’re interested in buying. If the item goes on sale and you’ve saved the full amount or allocated the cost in your budget, you can confidently purchase it without straining your finances.

4. Perform a “Life Cycle Cost Analysis”

Life cycle cost analysis considers not just the upfront cost of an asset but the total cost of ownership over time.

How You Can Use This: Apply the same principle to personal purchases by factoring in all associated costs.

For example, when buying a car, consider not just the sticker price but also ongoing costs like fuel, insurance, and maintenance. Similarly, when purchasing a property, remember that the initial purchase price is just one part of the equation. Factor in additional expenses like stamp duty, building surveys, legal fees, strata fees, council rates, and ongoing costs such as utilities and maintenance.

If the property has specific features, such as a swimming pool, don’t forget to account for its maintenance costs as well. These often-overlooked expenses can significantly impact your budget over time, so analysing the full life cycle cost ensures smarter financial planning.

5. Set a Contingency Fund for “Scope Creep”

In construction, “scope creep” refers to unforeseen changes that increase costs.

How You Can Use This: In life, it’s those extra wedding expenses or unexpected home repairs that can throw your budget off track. Having a contingency fund specifically for predictable but irregular expenses can save you from dipping into your long-term savings.

For large events like a wedding, create a detailed budget and proactively add a 10-20% buffer to account for unexpected costs you hadn’t planned for. This approach ensures you’re financially prepared for surprises, reducing stress and helping you stay in control of your finances.

6. Optimise Subscriptions with a “Cost-Value Ratio”

Quantity Surveyors assess whether a supplier’s costs align with the value they provide. The same principle applies to your subscriptions.

How You Can Use This: Not all subscriptions are worth the price. Review all your recurring subscriptions—streaming services, gym memberships, apps—and evaluate how much value you’re getting from each. Focus on the ones you truly use, enjoy, and find worth paying for—cancel the rest.

7. Treat “Cost Escalation” as a Financial Red Flag

Cost escalation in projects can signal trouble if left unchecked. Your personal finances are no different.

How You Can Use This: Monitor your spending in key categories like transport, groceries, or entertainment. If costs are creeping up month over month, investigate the reasons and identify ways to cut back. For example, switching to public transport, carpooling, or meal prepping could help reduce rising costs and keep your budget on track.

8. Apply the “80/20 Rule” to Your Spending

The 80/20 rule tells us that 20% of inputs often drive 80% of results. This principle is highly effective when applied to budgeting.

How You Can Use This: Identify the biggest drivers of your expenses—like housing, transportation, and food—and focus on optimizing those areas. Small changes in these categories can make a big difference to your overall budget.

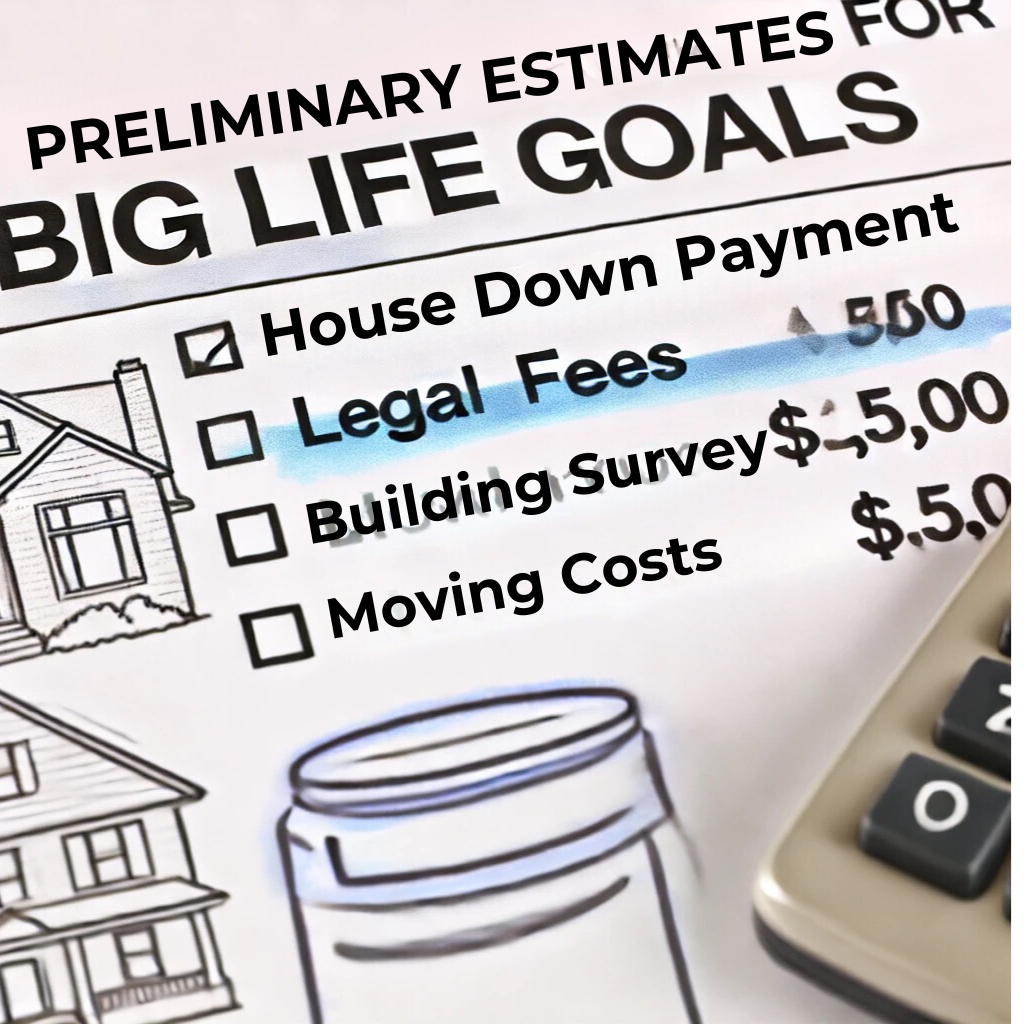

9. Use “Preliminary Estimates” for Big Life Goals

Before starting a construction project, QSs create rough cost estimates to assess feasibility. This approach works for personal goals too.

How You Can Use This: Break down big goals, like buying a house or planning a wedding, into smaller, manageable cost components. For example, calculate the down payment, legal fees, and moving costs for a home. Knowing these numbers upfront will help you save strategically and avoid surprises.

10. Build Relationships with Your “Financial Suppliers”

In QS, building strong relationships with contractors often leads to better deals. You can do the same with your financial providers.

How You Can Use This: Don’t be afraid to negotiate with your bank, insurance provider, or service companies. Ask for lower interest rates, better terms, or waived fees. The worst they can say is no, but the savings can add up if they say yes.

Start Applying Quantity Surveying Skills to Your Finances

The principles I use in my career have transformed how I approach personal finance. By thinking like a Quantity Surveyor, you can bring structure, strategy, and clarity to managing your money. The best part? You don’t need to work in construction to apply these ideas—they’re universal.

Have you ever borrowed strategies from your job to improve your personal finances or other areas of life? I’d love to hear how your professional skills have helped you outside of work. Share your story in the comments!

📩 Join my newsletter for more insights on financial independence & homeownership - Link to Subscribe!