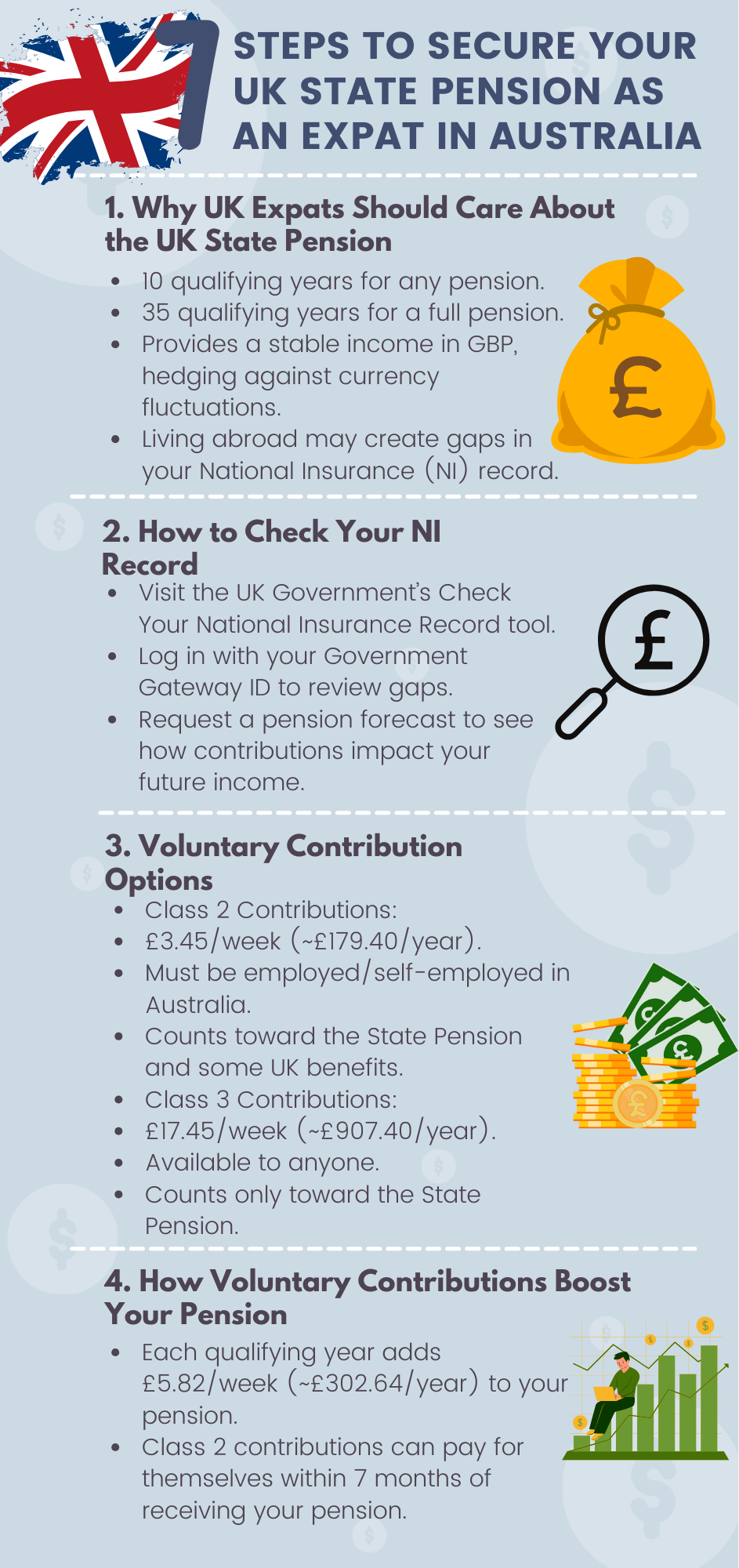

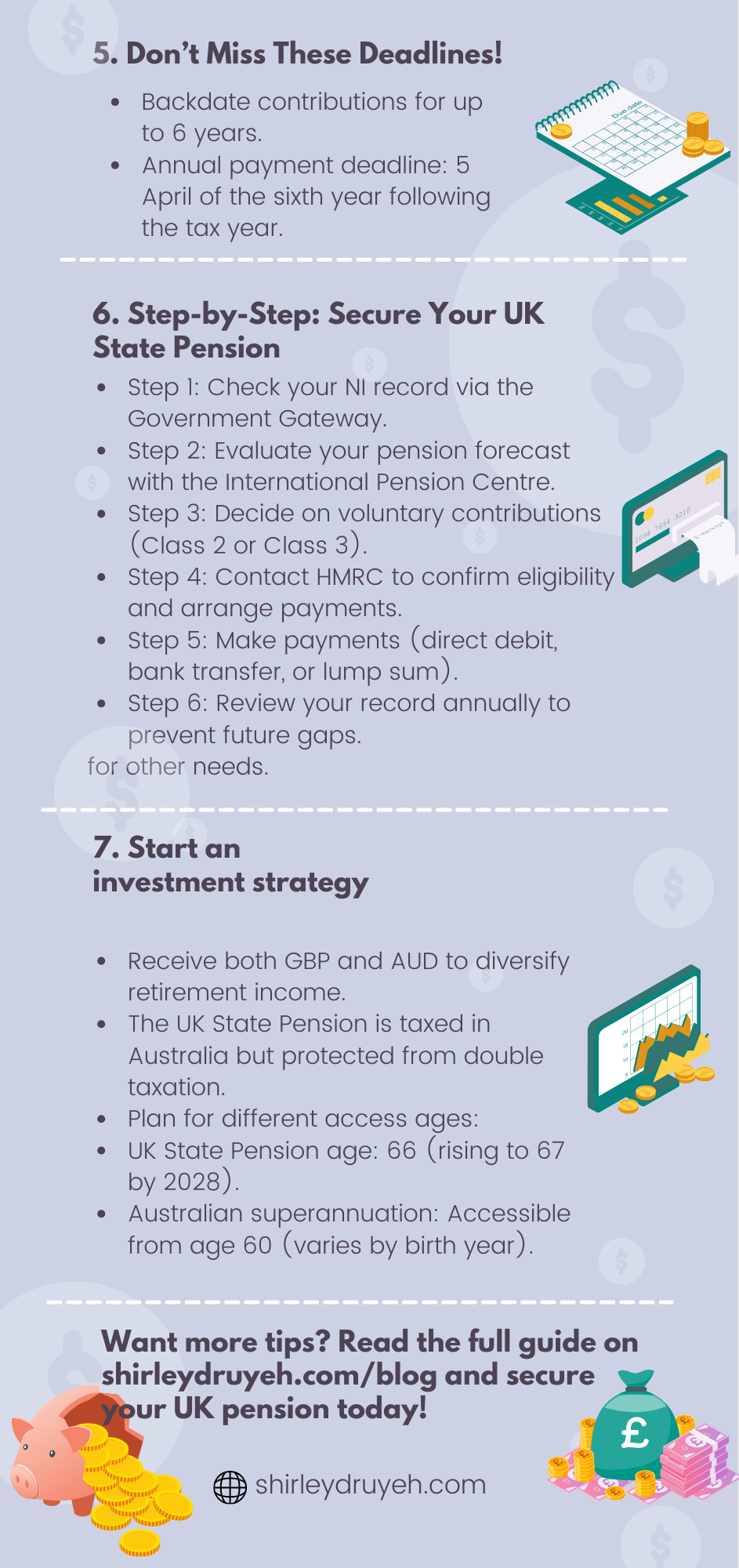

UK National Insurance Made Simple: A Guide for Expats in Australia to Secure Their State Pension

For UK expats in Australia, understanding your National Insurance (NI) contributions is the key to unlocking future State Pension benefits. If you’ve ever wondered how your NI status affects your retirement or what steps to take to address contribution gaps, this guide has everything you need to know.

What is the UK State Pension, and Why Should Expats Care?

The UK State Pension is a vital source of retirement income, even for those living abroad. It provides a guaranteed income in GBP, offering stability and a hedge against currency fluctuations. To qualify, you need:

At least 10 qualifying years of NI contributions for any pension.

A full pension requires 35 qualifying years of contributions.

Living in Australia often means you’re no longer automatically paying NI contributions, which can create gaps in your record and reduce your pension entitlement. This makes managing your NI contributions a critical task for securing your financial future.

Here’s a quick visual summary of how UK expats in Australia can secure their State Pension. Scroll down for a detailed step-by-step guide!

What is My Current NI Contribution Status?

Before you can take action, you need to understand your current position:

Check Your NI Record:

Visit the UK Government’s Check your National Insurance record website

Log in using your Government Gateway ID to see your contribution history and any gaps.

Request a Pension Forecast:

Contact the International Pension Centre or use the State Pension forecast tool.

This will show how much State Pension you’re currently entitled to and the effect of filling gaps.

What Options Do I Have for Voluntary Contributions?

If you have gaps in your NI record, you can fill them through voluntary contributions. However, eligibility criteria apply, and it's important to ensure you qualify before proceeding.

Check Your Eligibility:

Expats living abroad should complete Form CF83 to apply for voluntary contributions.

You’ll need to provide proof of your employment status and details of your contribution history.

👉 Apply to Pay Voluntary National Insurance Contributions (CF83 Form)

Once you’ve confirmed your eligibility, you can explore the two contribution options available:

1. Class 2 Contributions (The Cost-Effective Option)

Cost: £3.45* per week (~£179.40*/year).

Eligibility: Must be employed or self-employed in Australia.

Benefits: Counts toward both the State Pension and other UK benefits (e.g., bereavement support, though not applicable in Australia).

2. Class 3 Contributions (The Flexible Option)

Cost: £17.45* per week (~£907.40*/year).

Eligibility: Available to anyone, regardless of employment status.

Benefits: Counts only toward the State Pension.

How Will This Affect My Future UK State Pension?

Every qualifying year you add through voluntary contributions boosts your State Pension. For example:

Each additional year adds £5.82 per week* (about £302.64 annually*) to your pension.

This means one year of Class 2 contributions (£179.40*) could be recouped within 7 months of receiving your pension.

Voluntary contributions can significantly improve your pension entitlement, ensuring you maximise your benefits during retirement.

What Deadlines Do I Need to Be Aware Of?

📆 Recent Changes Affecting Expats in Australia, Canada, and New Zealand

As of 1 January 2022, certain periods of residence in Australia, Canada, or New Zealand may no longer counttowards your UK State Pension contributions, depending on your circumstances.

This change could impact how your contribution history is assessed.

It’s essential to review your NI record and check how these residency periods are being calculated.

For official guidance, visit the UK Government's State Pension Abroad Guidance.

📆 Deadlines for voluntary contributions are strict:

Backdating Contributions:

You can usually backdate contributions for up to 6 years.

Special extensions may apply, so 👉 check for updates on the UK Government website.

Annual Payment Deadlines:

Contributions for a given tax year must be made by 5 April of the sixth year following that tax year.

What Specific Steps Should I Take to Address Any Gaps?

Here’s a step-by-step guide to secure your State Pension:

Step 1: Check Your NI Record

Log in to your Government Gateway account to identify gaps in your contribution history.

Step 2: Evaluate Your Pension Forecast

Contact the International Pension Centre to understand your current entitlement and how filling gaps will impact your pension.

Step 3: Decide on Voluntary Contributions

Assess whether you qualify for Class 2 contributions. If eligible, this is the most cost-effective option.

If not, consider Class 3 contributions.

Step 4: Contact HMRC

Reach out to HMRC’s National Insurance Contributions Office to confirm your eligibility and arrange payments.

Provide evidence of employment (e.g., payslips, business registration) if applying for Class 2 contributions.

Step 5: Make Payments

Choose a payment method: direct debit, bank transfer, or lump sum.

Keep all receipts and records for future reference.

Step 6: Review Regularly

Check your NI record annually to ensure no further gaps develop.

How the UK State Pension Complements Australian Superannuation

Your UK State Pension can work alongside your Australian superannuation to create a diversified retirement income:

Dual Income Streams: Receiving GBP and AUD helps protect against currency risk.

Tax Implications:

The UK State Pension is taxed in Australia as foreign income.

However, under Australian tax rules, pension income may qualify for an 8% Undeducted Purchase Price (UPP) deduction, which reduces the taxable portion of your UK pension payments.

For more information, visit the ATO’s guidance on foreign pensions and annuities.

Thanks to the UK-Australia Double Taxation Agreement, you won’t pay tax twice on the same income.

Plan for differences in access ages:

The UK State Pension age is currently 66, rising to 67 by 2028.

Australian superannuation preservation age starts at 60 (depending on your date of birth).

Key Takeaways for Expats

Stay Proactive: Regularly check your NI record and address gaps early.

Prioritise Class 2 Contributions: If eligible, this is a low-cost way to secure your pension.

Plan for the Future: Consider how the UK State Pension fits into your overall retirement strategy.

Seek Advice: Consult with HMRC or a financial advisor to tailor your approach.

💡 Quick Note on the New State Pension (2016 Reform)

In 2016, the UK introduced the New State Pension, changing how pension entitlements are calculated. While this affects everyone who reached State Pension age on or after April 6, 2016, expats are often impacted by transitional rules and historical contribution calculations. If you think these changes might affect your pension, consider reviewing your entitlement via the State Pension Forecast Tool or consulting with a pension specialist.

Useful Contacts

HMRC National Insurance Contributions Office: +44 191 203 7010

International Pension Centre: +44 191 218 7777

By addressing your NI contributions now, you can secure a more comfortable and stable retirement while living in Australia. Take the first step today by reviewing your NI record and making informed decisions about your pension future.

Disclaimer

Financial Disclaimer:

Please note, I am not a financial advisor. The information provided in this blog reflects my personal understanding of the UK National Insurance system and how it applies to expats living in Australia. It should not be taken as financial, tax, or legal advice. I strongly encourage readers to consult with qualified professionals, such as financial advisors or tax specialists, for advice tailored to their individual circumstances

*Currency Conversion Disclaimer:

Currency values fluctuate and can impact the cost and benefits of financial contributions, savings, or investments discussed in this blog. The exchange rates referenced, if any, are for illustrative purposes only and may not reflect the current or actual rates available at the time of your financial transaction. Please consult a reliable financial institution or currency exchange service for accurate and up-to-date conversion rates before making any financial decisions.